RGR Marketing VP Silas Ellman recently completed a study with his partners at iLeads to determine

1. What percent of his leads turned into a funded loan and 2. What happened to the leads that RGR’s clients didn't close.

The results were nothing short of shocking.

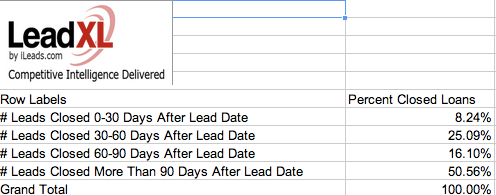

A good lender will close internet generated mortgage leads between 2-4%. iLeads has studied hundreds of thousands of leads and they have concluded that roughly 20-30% of people filling out a mortgage forms online will turn into a funded loan with 180 days. Why such a big discrepancy between the original lead buyer’s conversion rate and the overall conversion rate?

In our case study over 50% of leads were closed after 90 days. What was most surprising to us is that majority of the leads were not closed by our customers (who we originally sold the leads to)

When we looked at the data we were shocked to see the names of the top 15 closers were mostly “big banks” who wound up closing more than half of these loans not the original lenders that the leads were sold to -

Our partners were definitely up there closing loans but how we can get more of our partners up there at the top percent of closed loans is the point of this study. We hope to be able to give you some idea about how you can close more loans.

Why Aren’t Our Partners Closing More Loans?

As the data suggests over 50% of the loans are closed after the first 90 days and up to 180 days, which reminds me of our # 1 Tip for lenders which we wrote about on the blog previously - Persistence Pays! By giving up too easily, you lose out on opportunities in lieu of the next “slam dunk” deal. Not every deal will be easy. Some you have to work for but they are even more rewarding! Don’t let a lead you paid for go from hot to cold.

Take A Look At What Your Competition Is Doing

Are your rates as competitive as your competition? Consumers are smart and savvy and they have the internet on their side. It takes only seconds to bring up the rates of dozens of lenders vying for their business. A difference of even a tenth of a percentage point is enough to make them choose another lender, so keep an eye on the rates around you. If you can afford to beat them, do it. If not, match them.

What Does Your Infrastructure Say About You As A Mortgage Lender?

No matter what your business may be, you need an infrastructure that supports it. You can’t expect to run your organization without organization! A lead management system can help lenders keep on top of vast amounts of data and help your sales organization increase the efficiencies of managing and closing leads far more effectively than with conventional lead management approaches. Infrastructure failures can also be things like not having given your sales force the proper training or just plain old bad management will do the trick every time as well.

Is The Tail Wagging The Dog?

In mortgage lending we see a lot of situations where organizations are being run by employees or a sales force and not management. Management needs to make executive decisions that move the whole organization forward organically. Good lenders regularly sit down with their sales team and go over best practices and review how their operations will be run. It’s easy to allow sales to run the show when they are bringing in the money, but ultimately, it’s not sales who run the business its management.

At RGR Marketing we believe you have to create an infrastructure that makes it easy for your sales people to be successful by -

1. Putting the proper lead management systems in place and

2. Communicating with them about strategy and creative tactics that executives decide on and pass on to the sales team to work on implementing, not the other way around!

Always keep an eye on your competition and what they are doing well or where you may be able to outshine them. Last but definitely not least, it's always good to be able to beat them on price whenever possible.

Start making more

money today!

Search Categories

Tags

Tag Cloud

Latest from Twitter

Contact Us

Call us at 310-540-8900 or fill out the form below and we’ll tell you how you can get high quality leads for free*.

* Get up to 10% free leads on your first order!